The Wallace Insurance Agency for Beginners

Wiki Article

The Wallace Insurance Agency for Dummies

Table of ContentsThe Ultimate Guide To The Wallace Insurance AgencyWhat Does The Wallace Insurance Agency Mean?Some Ideas on The Wallace Insurance Agency You Need To KnowSome Ideas on The Wallace Insurance Agency You Should KnowNot known Details About The Wallace Insurance Agency 9 Simple Techniques For The Wallace Insurance AgencyFascination About The Wallace Insurance Agency6 Easy Facts About The Wallace Insurance Agency Shown

These strategies additionally provide some defense component, to assist guarantee that your beneficiary obtains monetary payment must the unfortunate take place during the period of the plan. Where should you start? The easiest method is to start thinking concerning your top priorities and needs in life. Right here are some questions to get you began: Are you trying to find greater hospitalisation protection? Are you concentrated on your household's well-being? Are you trying to save a wonderful sum for your child's education and learning needs? Lots of people start off with one of these:: Against a history of climbing clinical and hospitalisation prices, you may desire bigger, and higher insurance coverage for clinical expenditures.: This is for the times when you're hurt. For circumstances, ankle joint sprains, back sprains, or if you're knocked down by a rogue e-scooter biker. There are additionally kid-specific plans that cover play ground injuries and illness such as Hand, Foot and Mouth Condition (HFMD).: Whole Life insurance policy covers you for life, or usually up to age 99. https://gravatar.com/robertkroll83642.

The Best Strategy To Use For The Wallace Insurance Agency

Relying on your coverage plan, you obtain a round figure pay-out if you are permanently handicapped or seriously ill, or your loved ones receive it if you pass away.: Term insurance policy provides coverage for a pre-set duration of time, e - Liability insurance. g. 10, 15, two decades. Because of the shorter coverage period and the lack of cash worth, premiums are usually reduced than life plans, and supplies yearly cash money advantages on top of a lump-sum quantity when it grows. It usually consists of insurance policy coverage against Complete and Permanent Handicap, and fatality.

Some Ideas on The Wallace Insurance Agency You Should Know

You can choose to time the payment at the age when your youngster goes to university.: This gives you with a month-to-month earnings when you retire, typically on top of insurance policy coverage.: This is a way of conserving for short-term goals or to make your money job harder against the pressures of inflation.

5 Easy Facts About The Wallace Insurance Agency Shown

While obtaining different plans will certainly provide you more comprehensive coverage, being excessively safeguarded isn't an advantage either. To prevent undesirable financial stress and anxiety, contrast the policies that you have versus this list (Liability insurance). And if you're still uncertain concerning what you'll need, just how much, or the kind of insurance to obtain, speak with an economic advisorInsurance coverage is a long-lasting dedication. Constantly be prudent when deciding on a you could try here plan, as switching or terminating a plan too soon typically does not generate economic advantages.

See This Report on The Wallace Insurance Agency

The ideal component is, it's fuss-free we instantly exercise your cash streams and offer money suggestions. This short article is implied for info only and should not be counted upon as monetary suggestions. Prior to making any decision to acquire, market or hold any investment or insurance product, you should consult from a financial consultant concerning its suitability.Spend just if you comprehend and can monitor your financial investment. Expand your financial investments and avoid investing a large part of your money in a solitary product company.

Unknown Facts About The Wallace Insurance Agency

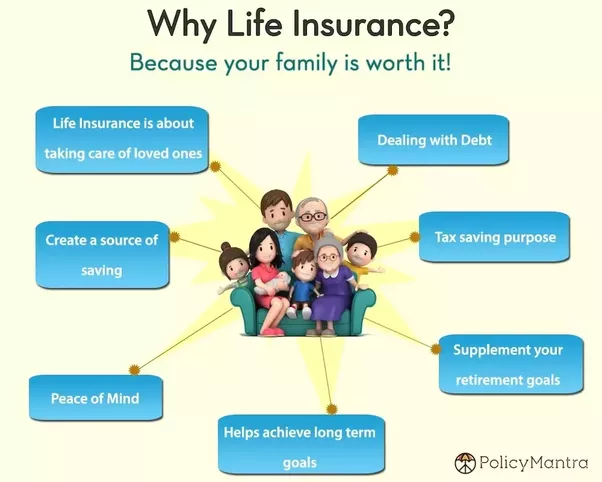

Life insurance coverage is not constantly the most comfortable topic to talk about. Simply like home and auto insurance coverage, life insurance policy is vital to you and your family members's financial safety and security. Parents and functioning grownups normally require a sort of life insurance policy policy. To assist, allow's explore life insurance coverage in much more information, how it works, what value it might provide to you, and just how Bank Midwest can assist you discover the appropriate policy.

It will certainly help your family pay off debt, receive income, and reach major monetary objectives (like college tuition) in the event you're not below. A life insurance policy plan is basic to planning out these financial considerations. For paying a month-to-month costs, you can get a set quantity of insurance protection.

What Does The Wallace Insurance Agency Do?

Life insurance policy is right for practically everybody, also if you're young. People in their 20s, 30s and even 40s usually overlook life insurance.The more time it takes to open up a plan, the even more threat you face that an unexpected occasion could leave your household without insurance coverage or monetary aid. Depending on where you're at in your life, it's crucial to recognize exactly which kind of life insurance coverage is ideal for you or if you need any in any way.

About The Wallace Insurance Agency

As an example, a house owner with 25 years staying on their home loan might secure a plan of the exact same length. Or allow's say you're 30 and strategy to have children soon. Because instance, enrolling in a 30-year plan would certainly secure your premiums for the following three decades.

Report this wiki page